Initiation to Stable-Farming

If you are a degenerate having just completed your shitcoin YOLOing puberty; or just a down to earth DeFi maximalist who is not a fan of storing USDC on a USB stick and shoving it up your a** while waiting for inflation to bleed you dry, then this substack is for you.

While Stable-Farming will not buy you a lambo or pull back your portfolio from the wreckage of FTX, I consider it to be a valuable crypto life skill that will instil and nurture both discipline and awareness of DeFi and the mechanical actors that drive the show.

What is Stable-Farming?

Fundamentally Stable-Farming is “basic” DeFi treasury management, where the objective is to preserve value and add value to a pot of stable assets.

The strategies employed are highly centered around DeFi stablecoins, and make use of native yield generating mechanisms from available DeFi protocols, all while mitigating crypto native risks.

Though it may be tempting from a layman perspective to hyper simplify Stable-Farming to just “yield farming stablecoins”, let me take this opportunity to induce you to the science/art of Stable-Farming.

Why practice Stable-farming?

Preserving your dry powder to last the winter - We do not know the length or depth of this winter, but we know that the one with the most dry powder stands to better ride the next bull cycle.

Keeping your brain active and in touch with the markets - One of the biggest mistake I did in the last cycle was to sit out 2019-2020 which left me completely blind sighted when the raging bull market came.

Building a valuable skillset - One of the recurring narratives that we are seeing surface is market neutral strategies, or the ability to create returns in spite of market adverse conditions.

Before I bore you anymore, let’s get working!

Pure Stable-Farms

If I gave you USDC 1,000,000 to park for 1 month and I asked you to make it produce something while holding you liable to pay back the capital (like yours truly), the most likely responses on a spectrum right now might be:

Strategy 1 - Park it on Aave for 1.00 % APR —> Super Conservative;

Strategy 2 - Provide liquidity on a Uniswap V3 USDC/USDT (0.01) for 7.00 % —> Pray for no USDT bank run; or

Strategy 3 - Buy some Liquity LUSD Chicken bonds for 55.00 % APR! —> Chickens only go up

All 3 strategies are valid, however given that a US 1 year treasury (risk free) yields around 4.10 %; Strategy 1 means you get fired straight away, Strategy 2 is basically russian roulette with a USDT themed bullet, and Strategy 3 means you are putting your cock on the block while juggling with knives.

Don't be Silly, Protect your Willie

Once you move outside of USDC, BUSD, DAI stablecoins (the holy trinity of asset backed stables) and the blue chips of DeFi protocols (Aave, Uniswap, etc… ) you should trust nothing and no one, no matter how much the next Do Kwon convinces you of otherwise.

However there is barely anything to eat if you stay purely in USDC, BUSD, DAI, and things are even worse if you restrict yourself to blue chip protocols like Aave and Uniswap, so you need to venture out of the green zone if you want to make a living.

What can go wrong?

Strategy 2 - USDT depegs and you are left holding a big bag of USDT,

This is the biggest weakness in providing liquidity into AMMs, you are always left holding the shittiest coin after an event.

Strategy 3 - You are not good math, and realise you bought LUSD at a premium and its going back to peg, or Liquity gets hacked.

4 out of 5 chicken bond investors I spoke to have no clue how chicken bonds work.

How to protect myself against AMMs depegs?

Using the above as an example, you can engineered a USDT depeg-protected Stable-Farm by borrowing the weaker stablecoin (in this case USDT).

Aave V2 lets you borrow up against up to 85 % of the TVL of your deposits, however this is upped to 97 % in Aave V3 if you enable e-mode.

By borrowing USDT to farm your USDT pair, you are effectively short USDT.

A scenario where USDT is worth more than USDC is very unlikely if not statistically insignificant, but the strategy still lets you hold an upside depeg to 1.054 in that upside down event (liquidation at 92%/97%).

If USDT depegs your USDC/USDT farm will be 100% USDT, but most importantly, you will be able to repay your USDT loan on Aave and get your USDC collateral back, unimpaired.

With slippage and volatility your gross return in USDT will also likely be much higher than the projected 7.00 %, thus potentially over compensating for a case scenario of a hard depeg.

In terms of protocol risk, you are only exposed to Uniswap and AAVE which are blue chip DeFi protocols.

How about my chicken farms?

The same principle can be applied for the chicken bonds: by depositing USDC and borrowing LUSD you recreate the same risk isolating mechanisms, though you would then be taking on Liquity protocol risk. However given LUSD is tied to Liquity we can consider the stablecoin risk being same with the protocol.

Same as for the USDC/USDT farm, the returns are diluted, but we have isolated the LUSD risk and the Liquity protocol risk as well (LUSD is tied to Liquity).

The collateral buffer from borrowing 750,000 LUSD against 1,000,000 USDC of collateral on Aave v2 ((liquidation at 85%/75%) puts the liquidation price at 1.13, a very safe margin to be borrowing LUSD.

Synthetic Stable-Farms

Now that you are familiar with the principle of wrapping higher risk stablecoins on Aave to take out the asset risk, let’s take the same process one step further with non-stablecoin farms.

The expansion of DeFi has brought forward a plethora of pseudo assets that are meant to be “pegged” to the other versions of themselves, the most common and prolific one being liquid ETH.

Liquid ETH is ETH that are staked in the Ethereum PoS validator system for which the validator have issued a depositary receipt, hence a “liquid” instrument. They all vary by mechanics:

stETH rebases

RETH accrues interest

wstETH wraps stETH such that all rebases are allocated to the wstETH

Though they all have the same underlying broad accrual mechanisms, YOU SHOULD DEFINITELY UNDERSTAND how each of them work before farming any of those pairs. Either that or go through a liquidity manager like Gamma Strategies, Arrakis Finance or xToken Terminal who understand how to provide liquidity for those exotic assets.

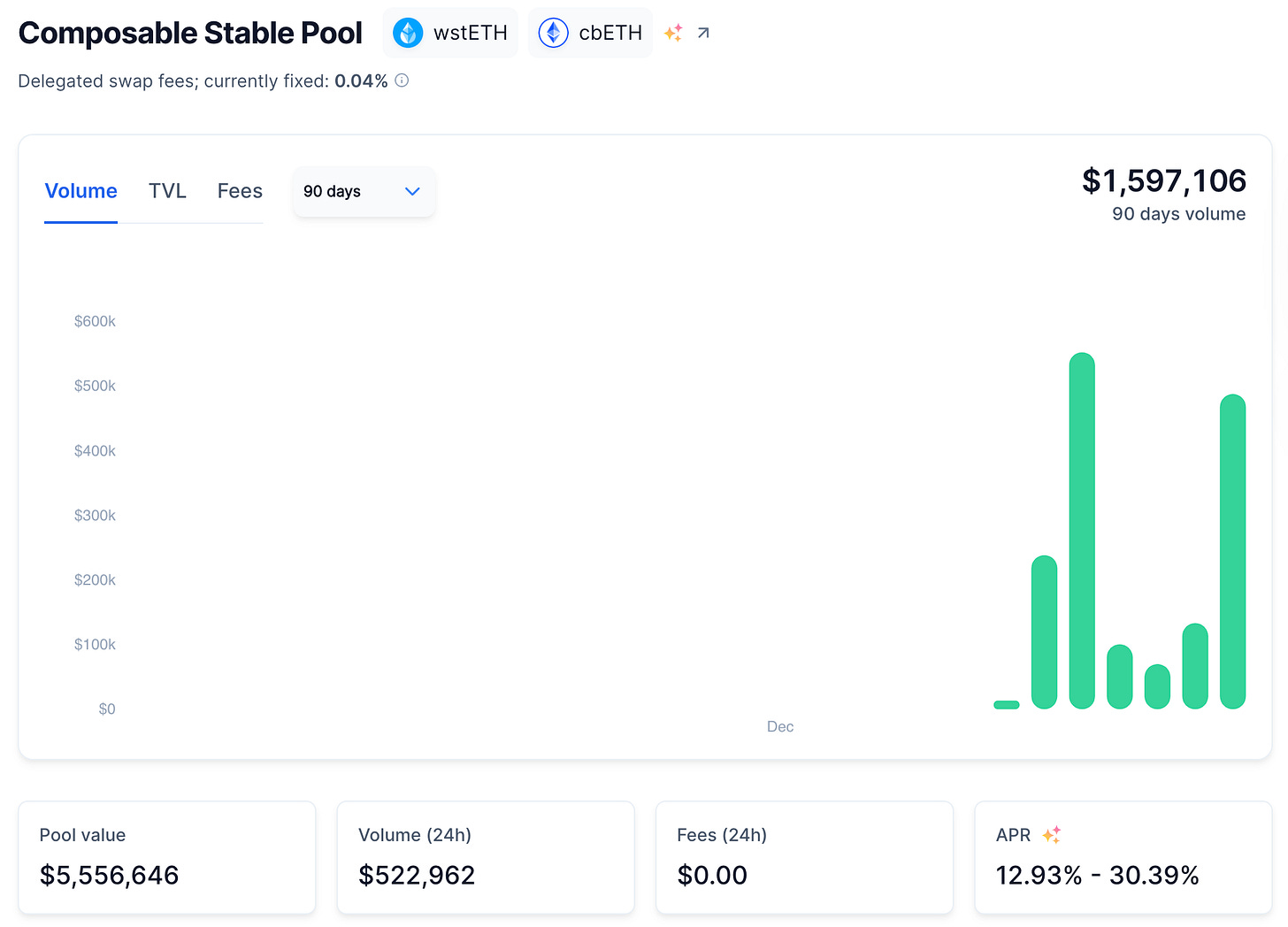

Here is an example of a pegged farm, a balancer wstETH-cbETH farm:

As you can see the yield is not bad (though it is incentivised).

From Stable Assets to Pegged Assets

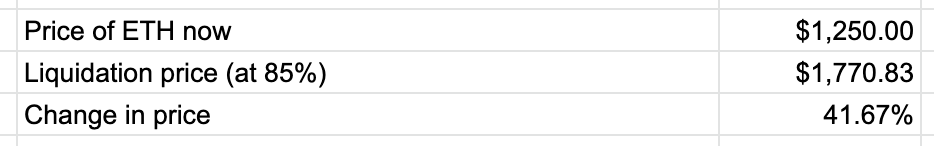

If you are adding synthetic Stable-Farms to your arsenal, there is one thing that you need to be really cautious about, liquidation.

Here is an example of a synthetic Stable-Farm, and the liquidation pain points.

In the above situation we are turning a 30.39% liquid ETH farm into a 17.64% stable farm.

The main advantage of using pegged assets is that is broadens the scope of investable assets from which we can create a Stable-Farm, hence diversify our risks.

In addition pegged asset farms generally generate higher yield than pure stablecoin farms, so it’s really worth making the extra effort.

But here is the catch:

If the pegged asset moves up 42% in USD terms, you will get liquidated on Aave.

This volatility of using directional pegged assets is a double edged sword:

If the pegged asset goes up by 20%, so does your net yield.

If the pegged asset goes down by 20%, so does your net yield.

This is because your yield is paid in kind.

While the strategy is overall market neutral, the return can be subjected to the whims market volatility, something to be very mindful of.

Gearing

Internal Gearing

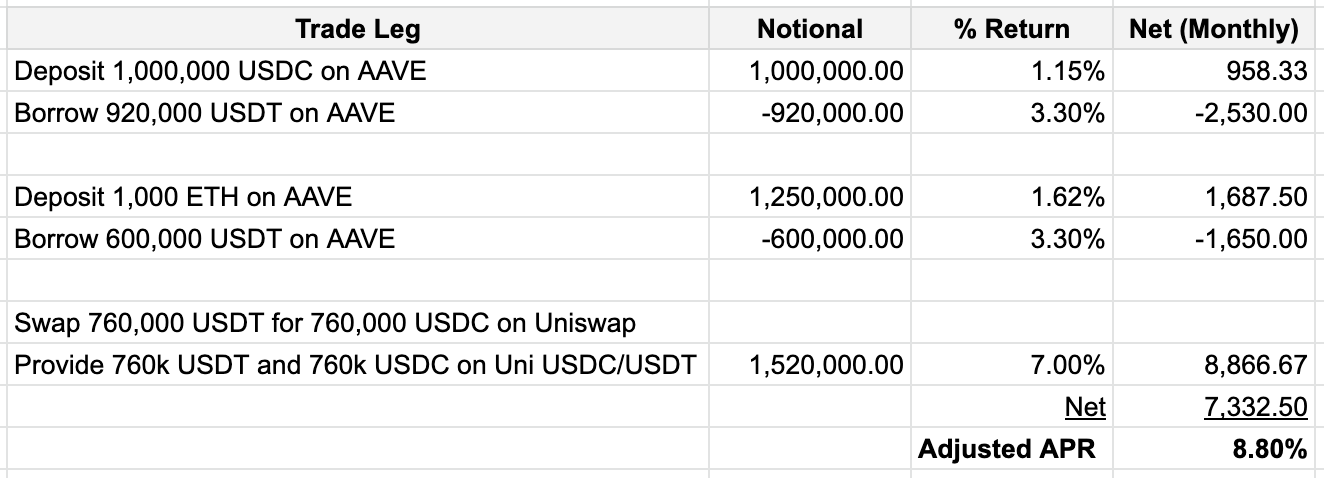

If you are a detailed oriented person, you must have realised that there is one potentially dangerous variable that we are not looking at, the interest spread between the supplied asset and the borrowed asset.

As you can see we are actually paying a price for shorting the risky asset, and that price is the interest spread. This rate is a floating rate, so in adverse market conditions, those can quickly widen and potentially make our Stable-Farm unprofitable.

This internal gearing is something that you need go be constantly cautious about, it is the Stable-Farmers’ silent killer.

Upping your internal gearing

Internal gearing does not need to always be adversarial to returns. The reason why our base cases are negative, is because we are paying a “premium” to stick to Aave which is the safest bank on DeFi.

If we were to move to UwU lend as an example, the internal gearing returns would change drastically. It is VERY IMPORTANT to understand that by moving to lower tiered borrowing and lending platform you are adding protocol risks to your strategy and these decisions needs to be thought out carefully!

UwU Lend Lending and Borrowing Rates:

Reworking Chicken farm yields with UwU Lend:

As you can see we went from an adjusted APR of 36.85% to 46.46%!

External Gearing

External gearing happens when the leverage is located outside of the Stable-Farm: this can take the form of the investor borrowing money to leverage his Stable-Farm, either off chain of on chain. For the purpose of keeping things simple, we will stick to pure on chain strategies.

Borrowing with your own money

As you can see, we had passive assets in the form of ETH which we safely leveraged to boost the yield of the Stable-Farm.

When to leverage your farm:

You have supply-able assets doing nothing.

Your Stable-Farm strategy is 99.9999 % safe.

The Stable-Farm yield is worth leveraging.

Borrowing other people’s money

So what if you are completely broke?

Well DeFi has realised that early on and came up with native solutions like Gearbox, Alpaca Finance and Alpha Homora.

I will not go through those because by now you should understand enough on Stable-Farming to do your own homework.

Takeouts

There is more than meets the eye when it comes to Stable-Farming.

Greater rewards always tag along with greater risks, don’t be fooled by the yields.

Vertical and horizontal diversification is always a good strategy to increase both your returns and survival rate.

See you next time for more Market Neutral-ish discoveries.

I look forward to learning more